Brent and WTI: where differences lie

When you read or listen to the news about the oil market, you meet two mysterious words: Brent and WTI (West Texas Intermediate). Maybe you already know that they are the two major oil benchmarks. But do you know what differences between them are and why they have a different cost?

We have gathered the most important information about Brent and WTI you need to know to make a profit on them.

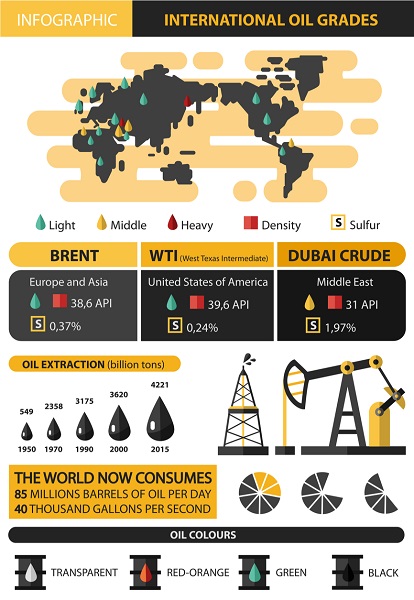

Let’s start with the basics. There are plenty of oil grades and varieties in the world. However, just three oil marks became oil benchmarks. They are Brent, WTI, and Dubai Crude. We will talk about Brent and WTI. They are the most frequently used as they are ideal for refining into gasoline.

Why were these benchmarks created?

It happened at the end of the 1980s when the OPEC (the organization of the world’s largest oil exporters) refused to regulate prices making them dependent on traders’ sentiment. To set an appropriate price, exporters needed an orienting point. Brent and WTI were created for that purpose. So, nowadays, each oil producer sets a price for oil it produces depending on how much it corresponds to the benchmark.

If you think that Brent or WTI means just one of the oil grades, you are wrong! They are a common name for different grades that have common characteristics.

Let’s take a closer look at these characteristics

- The first one is a location.

Brent is a standard for European and Asian markets. This benchmark consists of more than 15 oil grades produced on the Norwegian and Scottish shelf blocks of Brent, Ekofisk, Oseberg, and Forties.

WTI is a mark for the Western Hemisphere. It is sourced from US oil fields, primarily in Texas, Louisiana, and North Dakota.

- The second characteristic is a chemical formula.

Firstly, it’s worth saying that there are no absolutely similar oil grades. Even grades that are included in Brent or WTI have a different structure.

Brent is low-sulfur oil of a light type. WTI is a denser oil grade. The quality of WTI is higher than the Brent’s one.

Why do Brent and WTI have different prices?

Since the middle of 80s WTI and Brent had traded at almost the same price. There were times when WTI was more expensive than Brent. However, currently, WTI has a lower price than Brent. The difference in prices varies between $10-$20 a barrel.

Mostly, prices depend on a cost of production and delivery.

Brent is produced near the sea, so transportation costs are significantly lower. Conversely, WTI is produced in landlocked areas. As a result, there are infrastructure problems that make it harder to bring surging North American production to the market and as a result, transportation costs become bigger.

Another important factor to take into consideration is geopolitical trouble. Middle East tensions weigh oil the most, especially Brent. Tensions lead to a decline in supply. You should remember that when the supply of any asset declines, prices go up. West Texas Intermediate is less affected because it is based in landlocked areas in the United States.

A price of WTI is formed by crude oil inventories. As soon as the number increases, WTI goes down. If the number of inventories declines, WTI rises. Here you should remember about a supply issue again.

So as you can see, the major benchmarks are affected by different factors. However, their trends are mostly similar. If Brent goes up, the WTI will go up as well with a high probability.

Making a conclusion, we can say that Brent and WTI will remain reliable oil benchmarks. If you want to trade in the oil market, choose one of them. However, choosing one of the benchmarks remember factors that affect their prices. By that, you will be able to forecast the future price more accurate and your trading will be profitable.