Oil In The Geopolitical Lens: Soars And Dips Under The Influence Of Global Events

The interconnections between global political events and oil prices have become fundamental for investors and traders. The past months have been rich in events significantly impacting the cost of black gold. Conflicts in the Middle East, the oil ceiling, and the Russian oil embargo have become key drivers of oil price fluctuations.

Amid uncertainty driven by geopolitical events, oil prices surged to record highs. However, a correction in oil prices is observed with a gradual improvement in the situation in the Middle East and an increase in demand. The question facing investors is whether there are prerequisites for further price growth or if everything depends on the dynamics of the political landscape. In this article, we will explore the impact of recent events on the global oil market and the prospects for developing this crucial commodity sector.

Increased demand and potential supply reduction

Since the beginning of October in the 23rd year, we have witnessed a noticeable decline in Brent oil prices, with the cost of barrels dropping from $95 to $72.5. The "head and shoulders" pattern worked successfully, exacerbating the overall decline in black gold.

XBRUSD, Daily

Bouncing off a strong level on the daily chart, the price holds around $78.8 per barrel. Support also comes from additional cuts in production by Russia, as confirmed by the statement of Russian Deputy Prime Minister Alexander Novak.

It is important to note that the oil demand continues to grow. Russian companies significantly increased oil exports to China. For example, in December, exports from the port of Kozmino reached a record 925 000 barrels per day, with 85% shipped to China. According to experts, this may be related to railway transportation development.

US Dollar outlook: potential depreciation ahead

An additional boost to strengthen oil prices may come from a possible interest rate cut in the US, weakening the dollar. Decreasing inflation, industrial inflation, and a stable key rate at 5.5 points for three consecutive months indicate the unlikely tightening of policy. The leadership of the US regulator subtly hints at the inevitable rate cut.

Also, the Dollar Index signals the weakening of the American currency. Recent events indicate that the index tested the 102-point mark and settled at 102.5. We expect it to reach the 100-point level, but likely after a corrective pullback preceding the bearish rally. This could create additional factors for strengthening oil in light of the possible decline in dollar prices.

US dollar index, Daily

Technical analysis

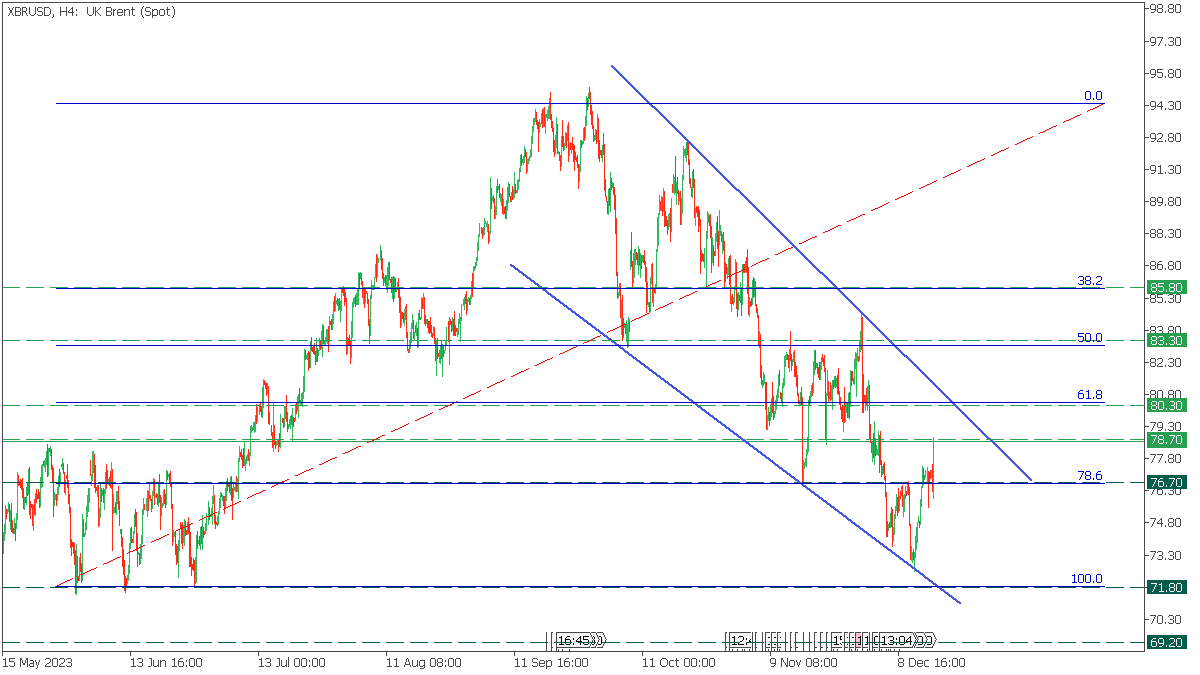

The critical resistance level will range from $77.6 to $78.6 per barrel. Breaking through this zone could catalyze further price growth to the Fibonacci level of 61.8%, equivalent to $80.50 per barrel. Moreover, if it surpasses $80.50 and the resistance trendline, it will likely proceed directly to the 50.0% and 38.2% Fibonacci levels, 83.30 and 85.80, respectively, indicating a potential shift toward a bullish trend.

XBRUSD, H4

Conclusion

The influence of global political factors on the oil market underscores the instability of this crucial commodity market. Recent events have created a volatile backdrop, affecting price dynamics. With an improving situation and increasing demand, the oil market is undergoing a correction after a period of growth. Whether this trend will persist or if new factors will influence prices remains open. In such a dynamic context, investor strategies must be flexible, based on careful event analysis and quick adaptation to the changing reality of the oil market.